Condo Insurance in and around Woodburn

Townhome owners of Woodburn, State Farm has you covered.

State Farm can help you with condo insurance

There’s No Place Like Home

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from theft, lightning, or weight of sleet.

Townhome owners of Woodburn, State Farm has you covered.

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

Despite the possibility of the unanticipated, the future looks bright when you have the excellent coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condo and personal property inside, you'll also want to check out liability coverage possible discounts, and more! Agent Justin Stearns can help you create a policy based on your needs.

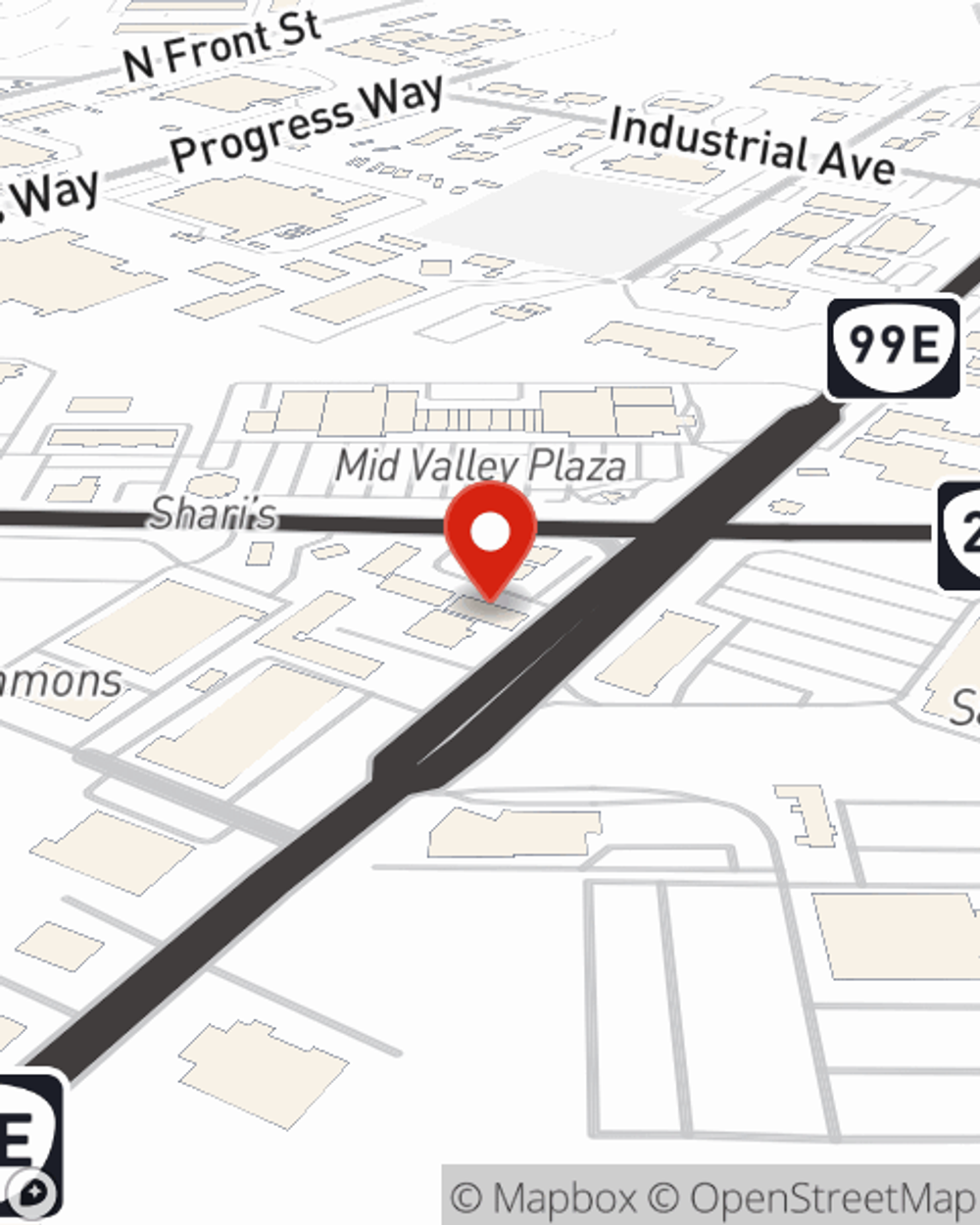

Dependable coverage like this is why Woodburn condo unitowners choose State Farm insurance. State Farm Agent Justin Stearns can help offer options for the level of coverage you have in mind. If troubles like wind and hail damage, drain backups or identity theft find you, Agent Justin Stearns can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Justin at (503) 981-7378 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Justin Stearns

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.